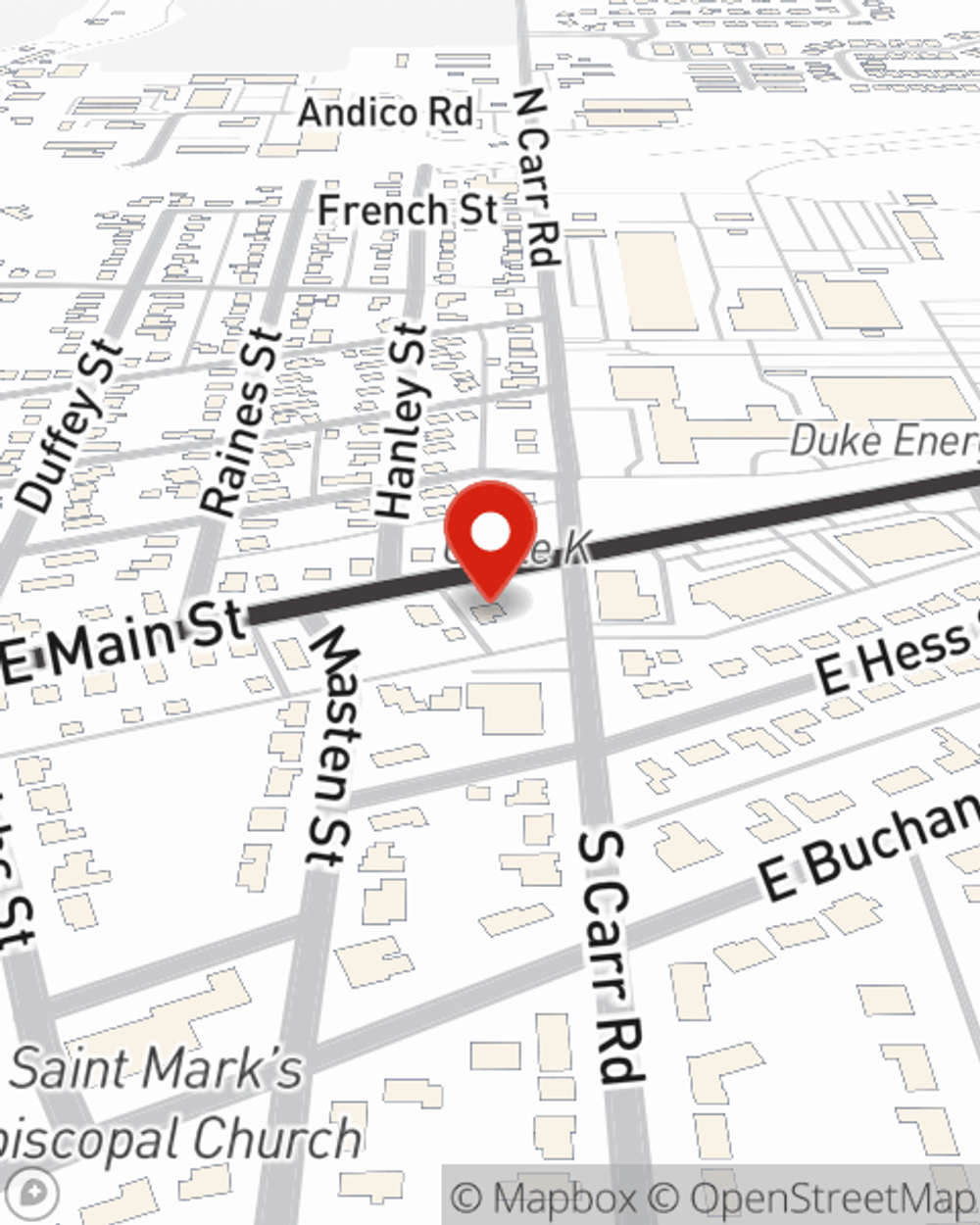

Business Insurance in and around Plainfield

One of Plainfield’s top choices for small business insurance.

Cover all the bases for your small business

This Coverage Is Worth It.

Do you own a HVAC company, a gift shop or a toy store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on what matters most.

One of Plainfield’s top choices for small business insurance.

Cover all the bases for your small business

Small Business Insurance You Can Count On

Your business thrives off your tenacity commitment, and having great coverage with State Farm. While you support your customers and put in the work, let State Farm do their part in supporting you with commercial liability umbrella policies, worker’s compensation and commercial auto policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Anissa Veon is here to help you discuss your options. Get in touch today!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Anissa Veon

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.